WHERE TO BUY

ASBIS supplies a wide range of IT products to its customers all over UAE. To find out retail store near you visit ASBIS Resellers section

Other headlines

ASBIS Group in 1st half of 2014: minimization of losses and solid fundamentals to come out of the crisis stronger and profitable

ASBIS saw its Q2 2014 and H1 2014 financial results still affected by the situation in Ukraine and Russia

Limassol, Cyprus, August 7 th , 2014 -- ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, saw its Q2 2014 and H1 2014 financial results still affected by the situation in Ukraine and Russia. Due to lower demand on those two markets, total revenues in Q2 2014 decreased by 22.19%, to USD 361.53 million, from USD 464.65 million in the 1 st half of 2013. This consequently affected the gross profit number. Additionally, in April and May the Company sold a large portion of inventories originally scheduled for sale in Q1 2014. This temporarily decreased the gross profit margin in Q2 2014, by 0.43% compared to Q2 2013. However, for the whole H1 2014 the gross profit margin was 4.82% higher than in H1 2013. Furthermore, the gross profit margin is expected to grow again in Q3 2014.

The Q2 2014 results were better than in Q1 2014; e.g. revenues grew by 5.59% due to partial redirection of sales lost in Ukraine and Russia to other markets. Additionally, the Company has begun cost-reduction measures to rescale the organization and adapt to market changes. This enabled a significant decrease in administrative and selling expenses. The cost-reduction program will be continued in Q3 2014. Therefore, the Company expects significant improvement in H2 2014 and profit generation from Q3 2014.

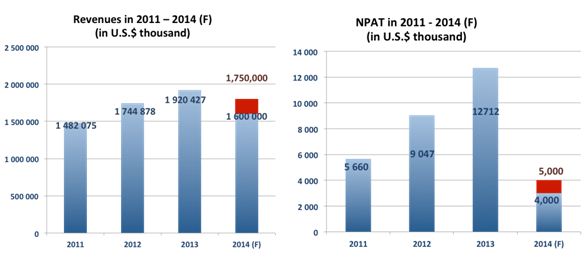

Revenues for the whole 2014 are forecast to range between USD 1.6 billion and USD 1.75 billion, and net profit after tax is forecast to range between USD 4 million and USD 5 million.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “We are currently operating in tough times, because two of our three top markets – Russia and Ukraine – have been affected by political and economic turbulence. This has affected demand and total sales have contracted. However, after a very tough Q1 2014 it seems we have found our way. We have redirected a part of the business lost in the F.S.U. region mostly to the CEE region and seen impressive growth in countries like Poland, Slovakia and the Czech Republic. Even if Q2 revenues were lower than a year ago, they were already higher than in Q1 of this year, and this is not the usual situation in the distribution business. We have also eliminated FX losses and introduced a deep cost reduction program in Q2 that allows us to save around USD 1 million every month. Hence we are confident of delivering profits this year and fulfilling our financial forecasts.”

Kostevitch continued: “ We believe that a greater concentration of our sales in CEE countries and increasing our current market share on those markets to replace business lost in Russia and Ukraine will benefit us doubly in the future. This is because we will have more market share in CEE when demand in Russia and Ukraine starts growing again, hence we will benefit from both regions.”

Financial results in Q2 2014 and Q2 2013 (USD '000)

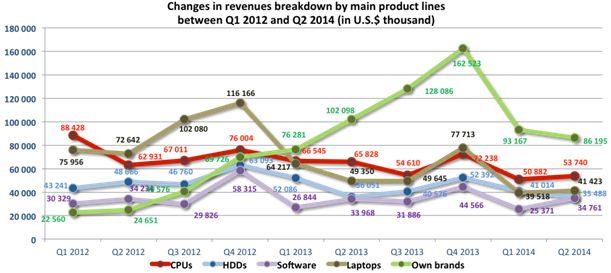

Q2 2014 Q2 2013 Change Revenues 361,535 464,654 ˗ 22.19% Gross profit 19,872 25,652 ˗ 22.53% Gross profit margin 5.50% 5.52% ˗ 0.43% Administrative expenses 7,299 7,400 ˗ 1.36% Selling expenses 10,924 12,395 ˗ 11.87% Operating profit 1,649 5,857 ˗71.85% EBITDA 2,356 6,514 ˗ 63.83% Net profit ( 1,443) 1,370 N/A H1 2014 H1 2013 Change Revenues 703,925 908,478 ˗ 22.52% Gross profit 42,108 51,848 ˗ 18.78% Gross profit margin 5.98% 5.71% + 4.82% Administrative expenses 15,194 14,285 + 6.36% Selling expenses 22,297 24,229 ˗ 7.97% Operating profit 4,617 13,334 ˗65.37% EBITDA 6,103 14,664 ˗ 58.38% Net profit (4,835) 4,699 N/A For 2014, ASBIS forecasts revenues between USD 1.6 billion and USD 1.75 billion and NPAT from USD 4.0 million to USD 5 million. This forecast reflects the impact of the crisis in Ukraine and Russia. H1 2014 was under great pressure from the turbulence in Ukraine that affected sales in a number of countries across our operations in both Q1 and Q2 2014. In Q2 2014 revenues from almost all the main product lines (except software) decreased or remained relatively stable compared to Q2 2013 (as in the case of HDDs). As a result, revenues from sale of all product lines in H1 2014 were lower than in H1 2013. However, the Company has already noticed progress compared to Q1 2014, as revenues from most of our major product lines grew due to refocussing sales from Ukraine and Russia to other markets. The same trends operated in the case of the own brands business. Revenues from the own brands business decreased in Q2 2014 compared to Q2 2013 by 15.58% and remained stable in H1 2014 compared to H1 2013 (growth of 0.55%). Consequently, the share of the own brands business in total revenues in Q2 2014 grew to 23.84%, from 21.97% in Q2 2013, and to 25.48% in H1 2014 compared to 19.63% in H1 2013. In order to offset the negative effects of the turbulence in Ukraine and Russia, the Company has focused on the development of own brand sales in other regions, most importantly CEE and Western Europe. The table below provides a breakdown of revenues by product category for Q2 2014 and Q2 2013: Q2 2014 Q2 2013 USD '000 % of total revenues USD '000 % of total revenues Smartphones 73,297 20.27% 112,149 24.14% Tablets 50,315 13.92% 79,700 17.15% Central processing units (CPUs) 53,740 14,86% 65,828 14.17% PC-mobile (laptops) 41,423 11.46% 49,350 10.62% Hard disk drives (HDDs) 35,488 9.82% 36,051 7.76% Software 34,761 9.61% 33,968 7.31% Other 72,511 20.06% 87,607 18.85% Total revenue 361,535 100% 464,654 100% The table below provides a breakdown of revenues by product category for H1 2014 and H1 2013: H1 2014 H1 2013 USD '000 % of total revenues USD '000 % of total revenues Smartphones 125,212 17.79% 192,895 21.23% Tablets 113,549 16.13% 137,494 15.13% Central processing units (CPUs) 104,622 14.86% 132,373 14.57% PC-mobile (laptops) 80,941 11.50% 113,567 12.50% Hard disk drives (HDDs) 76,503 10.87% 88,137 9.70% Software 60,132 8.54% 60,812 6.69% Other 142,967 20.31% 183,199 20.17% Total revenue 703,925 100% 908,478 100% For additional information, please contact: Daniel Kordel , ASBISc Enterprises PLC, Investor Relations Costas Tziamalis , ASBISc Enterprises PLC, Investor Relations Iwona Mojsiuszko , M+G ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide. The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio (smartphones, tablets, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, more than 1,700 employees and 32,000 customers. The Company's stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS). For more information, visit the company's website at www.asbis.com or investor.asbis.com

Financial results in H1 2014 and H1 2013 (USD '000)

Financial forecast for 2014

Detailed information on sales profile

Tel. +357 99 633 793

Tel. +48 509 020 021

E-mail: d.kordel@asbis.com

Tel. +357 25 857 000

E-mail: costas@asbis.com

Tel. +48 22 625 71 40

Tel. +48 501 183 386

E-mail: iwona.mojsiuszko@mplusg.com.pl