WHERE TO BUY

ASBIS supplies a wide range of IT products to its customers all over UAE. To find out retail store near you visit ASBIS Resellers section

Other headlines

ASBIS in Q1 2012: Increase in Revenues and Gross Profit and Decrease in Expenses Resulted in Dynamic Growth in Profitability at All Levels

In Q1 2012 revenues increased by 8.46% to USD 379.183M and net profit was USD 2.257M, for dynamic 172.41% Y-O-Y growth

Limassol, Cyprus, May 8 th , 2012 -- IN Q1 2012 REVENUES INCREASED BY 8.46% TO USD 379.183M AND NET PROFIT WAS USD 2.257M, FOR DYNAMIC 172.41% Y-O-Y GROWTH

ASBISc Enterprises Plc, a leading distributor of IT products in emerging markets of Europe, the Middle East and Africa, posted revenues of USD 379 million for the first quarter of 2012, or 8.46% higher than in Q1 2011. In the same time the Company's gross profit before currency movements grew by 10.28%. The Company's FX hedging mechanism was once again effective, with an insignificant impact on Q1 2012 results.

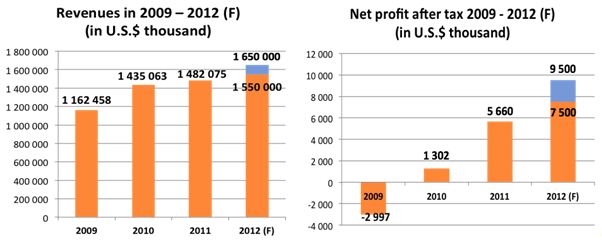

Expenses were reduced at all levels: financial expenses decreased by 14.77% and admin expenses by 5.91%, while selling expenses grew by only 0.43% despite strong growth in revenues and gross profit. This resulted in significantly improved profitability. Compared to Q1 2011, operating profit grew by 22.77% to 4.606 million, EBITDA grew by 17.28% to 5.284 million, and net profit grew by 172.41% to USD 2.257 million. Thus the Company is on track to deliver the financial results forecast for FY2012: USD 1.55 to 1.65 billion in revenues and USD 7.5 to 9.5 million in net profit.

“We have refined our product portfolio and slowed down growth of expenses,” commented Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc . “On one hand, this has resulted in sales growth in all major regions, including 7% growth in the FSU and 8.5% in CEE. On the other hand both admin and financial expenses have been reduced, and selling expenses have grown only slightly in absolute figures but effectively dropped as a percentage of sales and gross profit. Taking into consideration that the Q1 2012 results were not positively affected by FX gains, as was the case in Q1 2011, we consider this to be the beginning of a positive trend. Therefore, with the current effective hedging policy, our results are clear from FX risk and we now focus on our core business. This has driven productivity and efficiency, improved management of working capital and strengthened our market position in several countries where we operate. As a result, profitability at all levels—from gross profit, through EBITDA to net profit—has much improved.”

FINANCIAL RESULTS IN Q1 2012 AND Q1 2011 (in USD thousand)

| Q1 2012 | Q1 2011 | Change |

Revenues | 379,183 | 349,619 | +8.46% |

Gross profit before currency movements | 19,974 | 18,113 | +10.28% |

Gross profit margin | 5.27% | 5.56% | -5.22% |

Administrative expenses | 5,964 | 6,339 | -5.91% |

Selling expenses | 9,403 | 9,363 | +0.43% |

Operating profit | 4,606 | 3,752 | +22.77% |

EBITDA | 5,284 | 4,506 | +17.28% |

Net profit | 2,257 | 829 | +172.41% |

FINANCIAL FORECAST FOR 2012

For 2012 ASBIS forecasts revenues from USD 1.55 to 1.65 billion and net profit from USD 7.5 to 9.5 million.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “Having seen more than USD 2.25 million of net profit in Q1 this year, we can sustain our FY2012 financial forecast for net profit. We expect the rest of the year to be influenced by traditional seasonality, i.e., we expect to reach the breakeven point in Q2, profit in Q3, and achieve most of the forecast profit in Q4—traditionally the best quarter of the year for IT distributors. Meanwhile, we will continue our work on upgrading our product portfolio, e.g. by signing more A-brand franchise agreements and growing our own brands, which will allow us to generate higher gross profit margins, thanks to which we will further improve our profitability.”

DETAILED INFORMATION ON SALES PROFILE

In Q1 2012 revenues derived from FSU countries increased by 7.06%, to USD 155.37 million (40.97% of total revenues), and revenues in CEE grew even more, by 8.45%, to USD 122.45 million (32.29% of total revenues). In the same time revenues in the Middle East and Africa grew significantly, by 16.23%, to USD 60.21 million (15.88% of total revenues), as a result of the upgraded product portfolio and better market position in this region. Sales in other regions were stable, with 3.90% growth in sales in Western Europe and 2.12% growth in other markets.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “ This landscape is a result of the strategy of focusing on our main markets, which allows us to generate growing revenues at better margins than the saturated markets of Western Europe. The effects of this strategy are clearly visible in the income statement. Country-by-country analysis confirms that even with the recent turbulence in the world's economy, we have built a solid basis for revenue growth in 2012, and now we can benefit from it by upgrading our product portfolio in different markets. Russia, our biggest market, outdistanced the other main markets with a significant 10.92% growth in revenues, while in the traditional number two and three markets—Ukraine and Slovakia—we grew by 4.09% and 4.82% respectively. In the same time revenues derived from some other countries grew significantly (e.g. Kazakhstan by 47.35%), and this allowed the Company to produce an overall 8.46% growth in revenues. It is also worth mentioning that in Q1 2012 Belarus re-entered our top-10 list, confirming that the situation in the country is stabilizing after the 2011 turbulence.”

REVENUE BREAKDOWN BY REGIONS IN Q1 2012 AND Q1 2011 (in USD thousand):

Region | Q1 2012 | Q1 2011 |

Former Soviet Union | 155,368 | 145,126 |

Central and Eastern Europe | 122,453 | 112,908 |

Middle East and Africa | 60,209 | 51,801 |

Western Europe | 30,743 | 29,589 |

Other | 10,411 | 10,195 |

Total | 379,183 | 349,619 |

REVENUE BREAKDOWN IN Q1 2012 AND Q1 2011 - TOP 10 COUNTRIES (in USD thousand)

| Q1 2012 | Q1 2011 | ||

| Country | Sales | Country | Sales |

1. | Russia | 91,357 | Russia | 82,364 |

2. | Ukraine | 37,108 | Ukraine | 35,651 |

3. | United Arab Emirates | 33,666 | Slovakia | 31,854 |

4. | Slovakia | 33,391 | United Arab Emirates | 19,513 |

5. | Czech Republic | 19,823 | Czech Republic | 19,182 |

6. | Kazakhstan | 15,522 | Saudi Arabia | 14,082 |

7. | Bulgaria | 10,678 | Belarus | 13,877 |

8. | Netherlands | 10,022 | Kazakhstan | 10,534 |

9. | Romania | 8,290 | Netherlands | 9,163 |

10. | Belarus | 8,039 | Romania | 8,854 |

11. | Other | 111,287 | Other | 104,545 |

Total revenue | 379,183 | Total revenue | 349,619 | |

For additional information, please contact:

Daniel Kordel , ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

Tel. +48 509 020 021

E-mail: d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

Iwona Mojsiuszko , M+G

Tel. +48 22 625 71 40,

Tel. +48 501 183 386

E-mail: iwona.mojsiuszko@mplusg.com.pl

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide.

The Group distributes products of many vendors and manufactures and sells private-label products: Prestigio (external storage, leather-coated USB accessories, GPS devices, etc.) and Canyon (MP3 players, networking products and other peripheral devices).

ASBIS has subsidiaries in 26 countries, more than 1,000 employees and 32,000 customers. The Company's stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, visit also the company's website at www.asbis.com or investor.asbis.com